Yes, full PF can be withdrawn after leaving the company. So let us know the complete process of withdrawing PF.

Here we are explaining step-by-step how to withdraw PF after leaving the company

To withdraw full PF online, we need a UAN, password, and mobile number linked to Adhar.

First of all open the EPF portal. The link to the EPF portal is given below.

https://www.epfindia.gov.in/site_en/index.php

We will be able to see the service tab, so we will move the mouse pointer over the services tab.

Go to the service tab and click on For Employees section.

After clicking on For Employees, the members of the service will click on UAN / Online Services (OCS / OTCP) section.

section..jpeg)

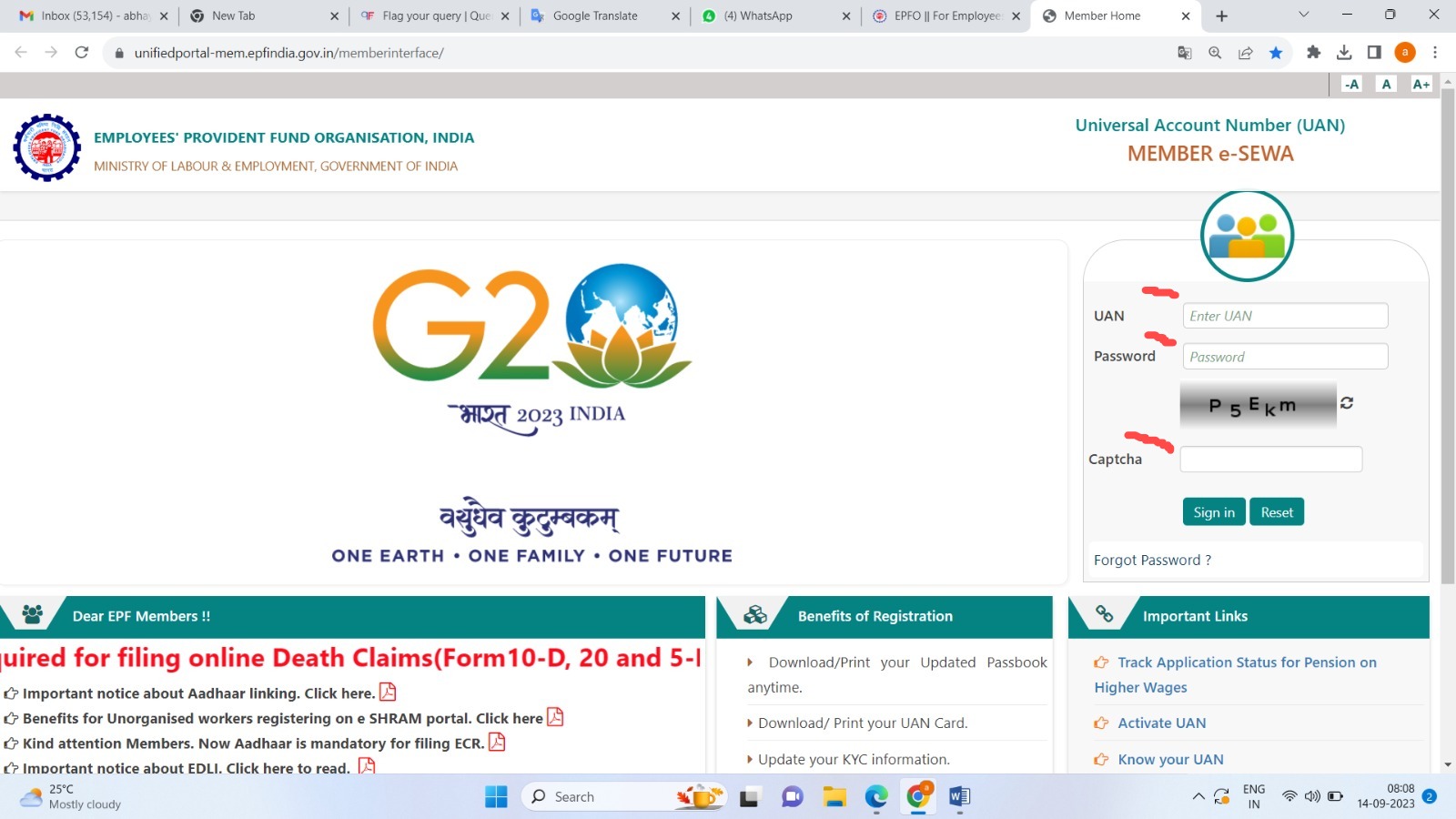

Go to the EPF login page insert UAN, password, and captcha, and click the sign-in button (If you don't have a Password click on forgot password and create a new password).

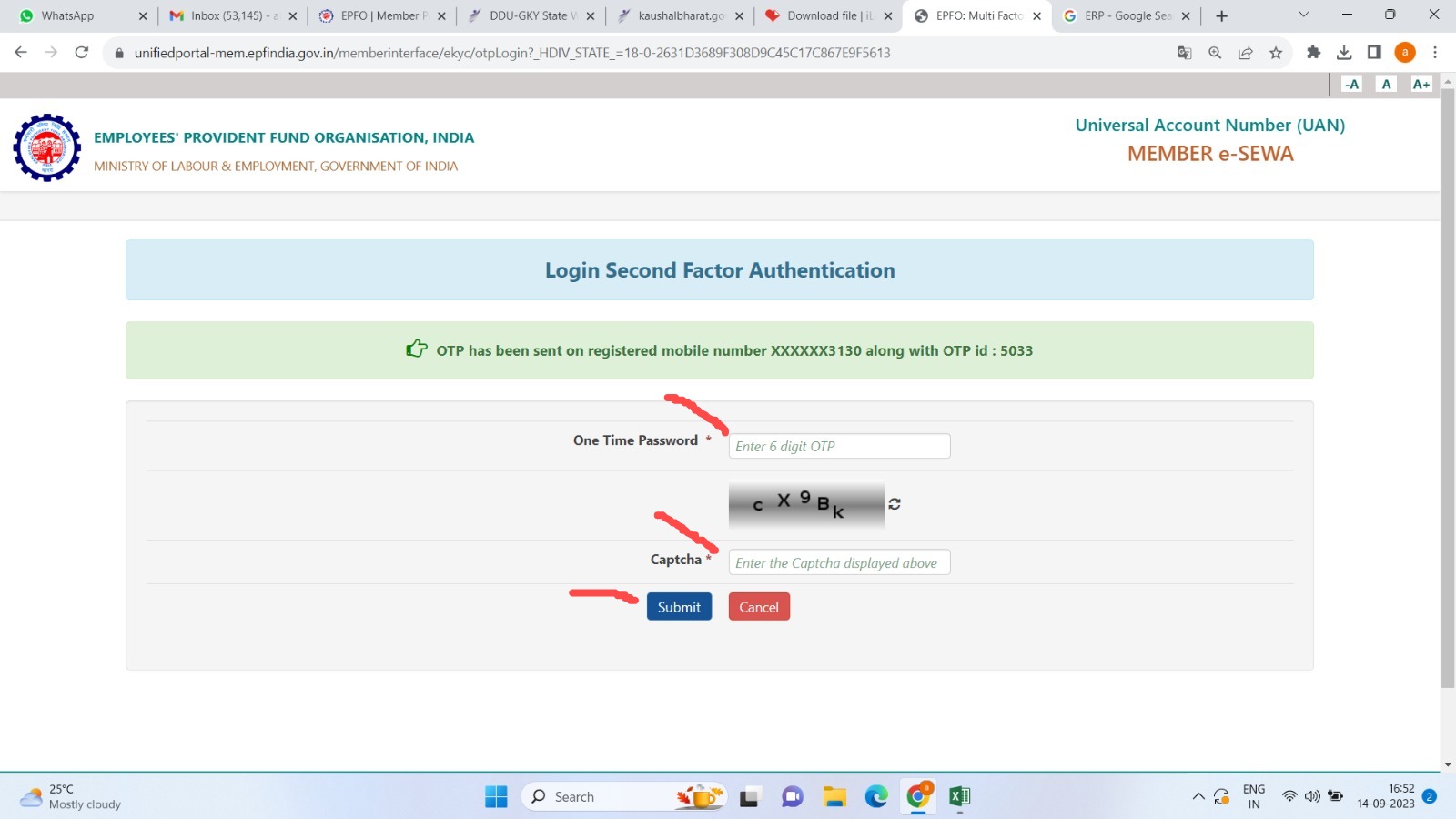

After clicking the login button, a message will be sent to the mobile number linked with Aadhaar which will contain a 6-digit OTP number. We will enter this OTP on the Login Second Factor Authentication page enter the captcha and click on the submit button.

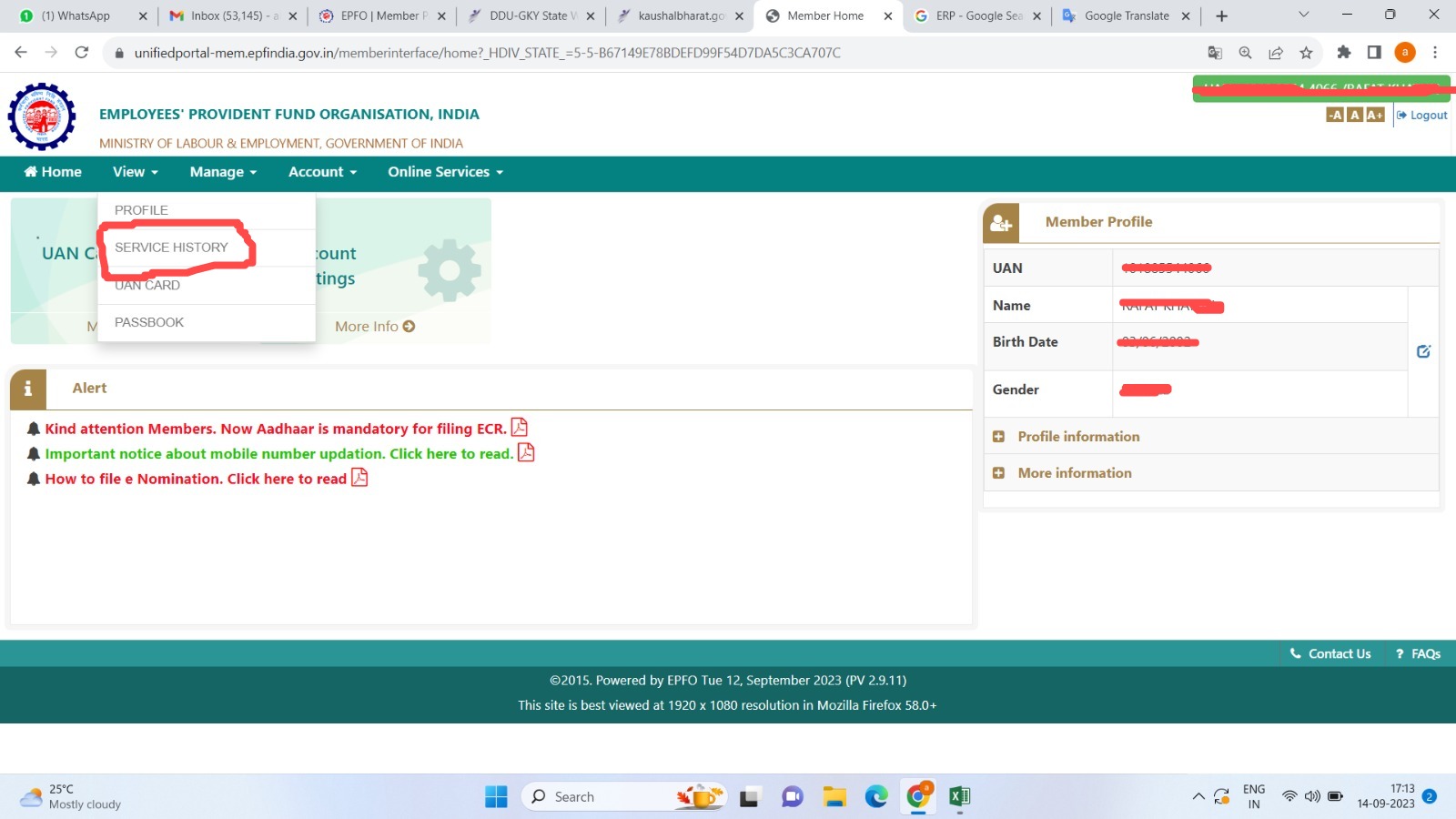

After login open the Home page, move the mouse pointer over the View button, and click on the Service History page.

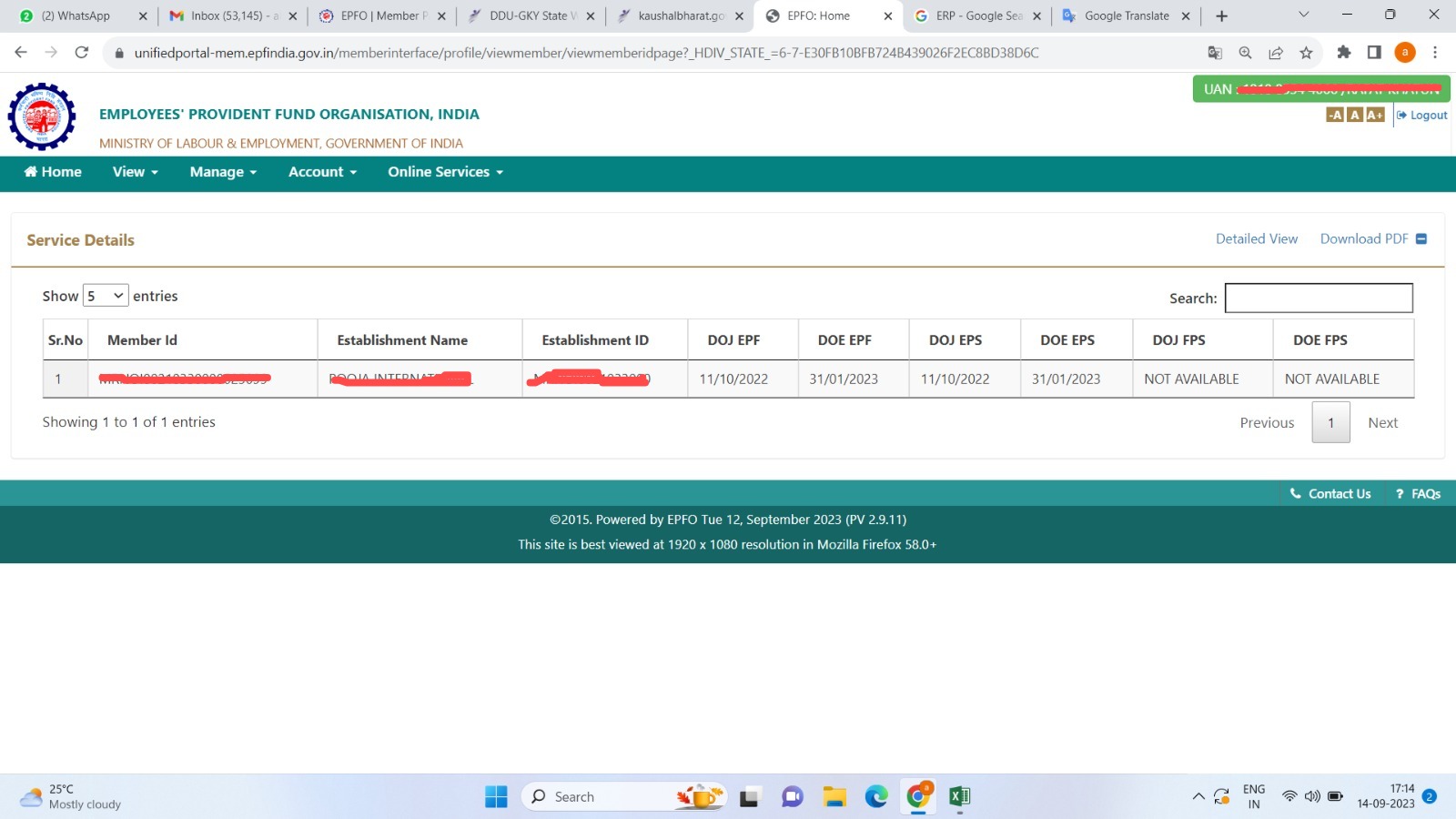

After clicking on the Service History page will open the Service history page where you will check whether the Date of Exit (DOE EPF) is updated or not. If DOE EPF is updated then. (If not updated then update itself Go to Manage Tab- click on Date of Exit - Select leaving date of company and submit ) .

If DOE EPF(Date of Exit) is Updated then Click on the online services Tab.

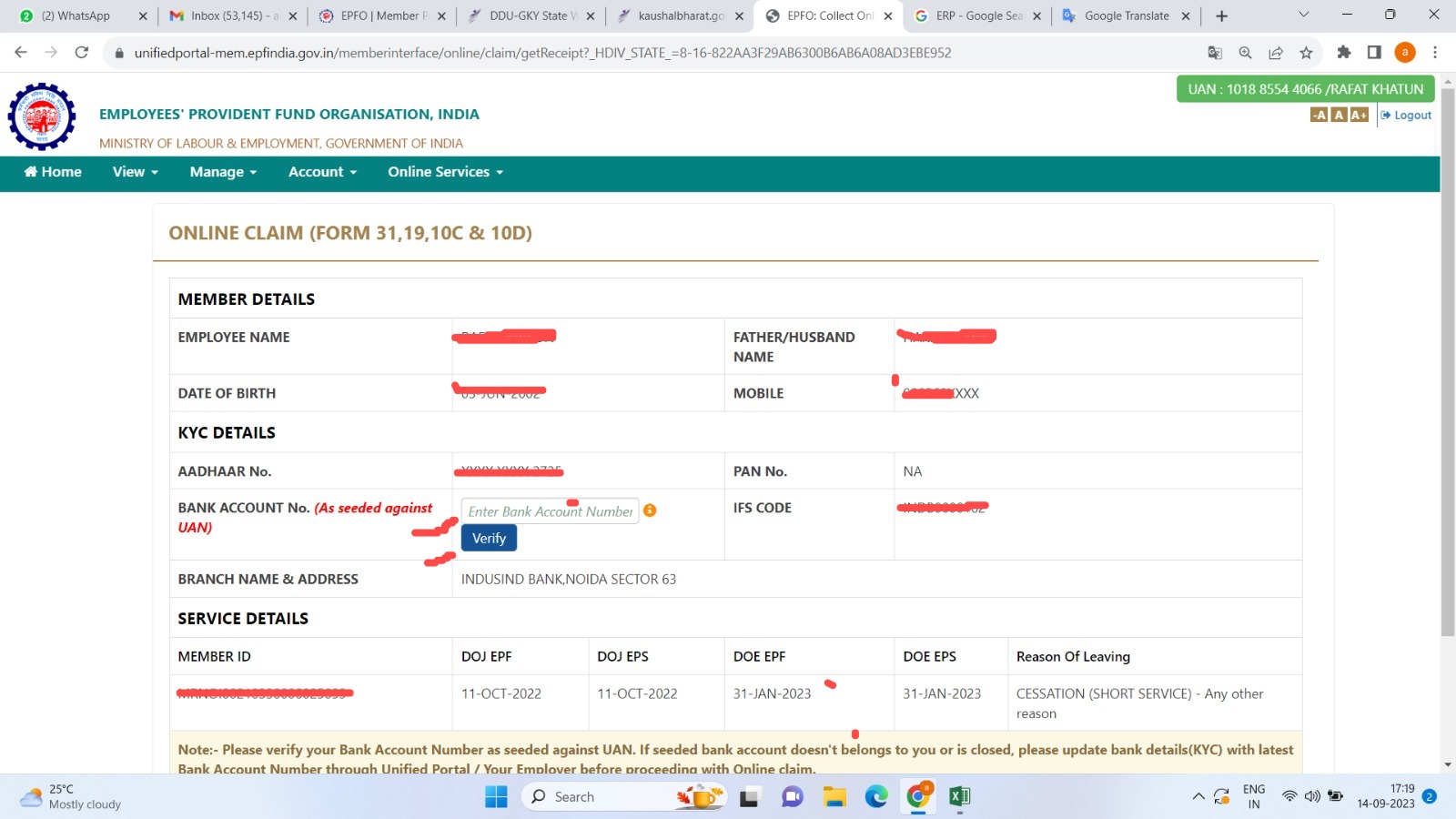

To withdraw the full amount of PF, click on the Claim (Form 31, 19, 10 C & 10 D) Tab.

.jpeg)

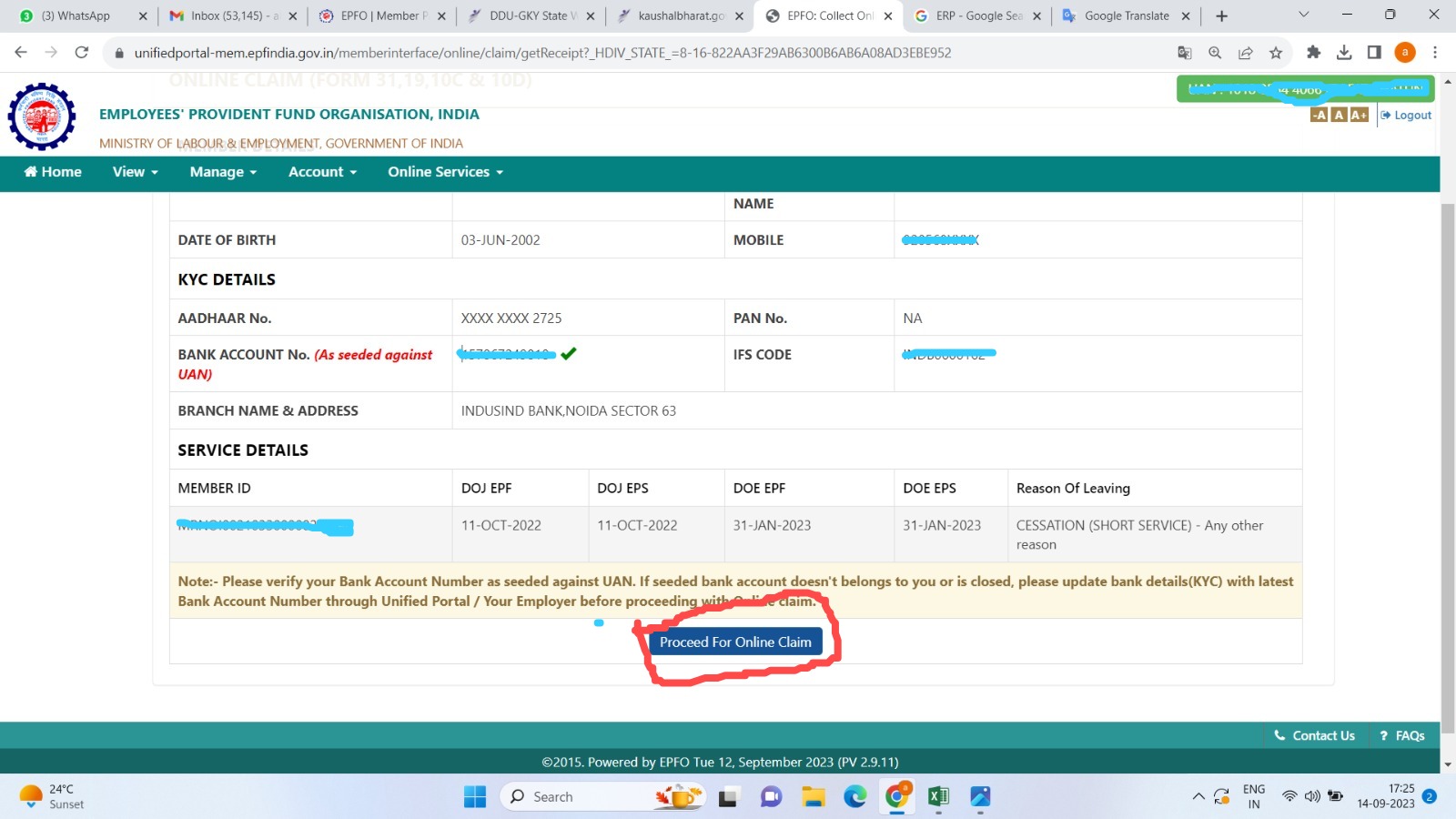

After clicking on the claim (Form-31,19,10C & 10D), a bank account number verification page will open You will insert your bank account number, then click on the verify button, which will verify the bank account, and at the bottom there will be a button of Proceed for Claim.

click on the Proceed for Claim button and go to the claim form page.

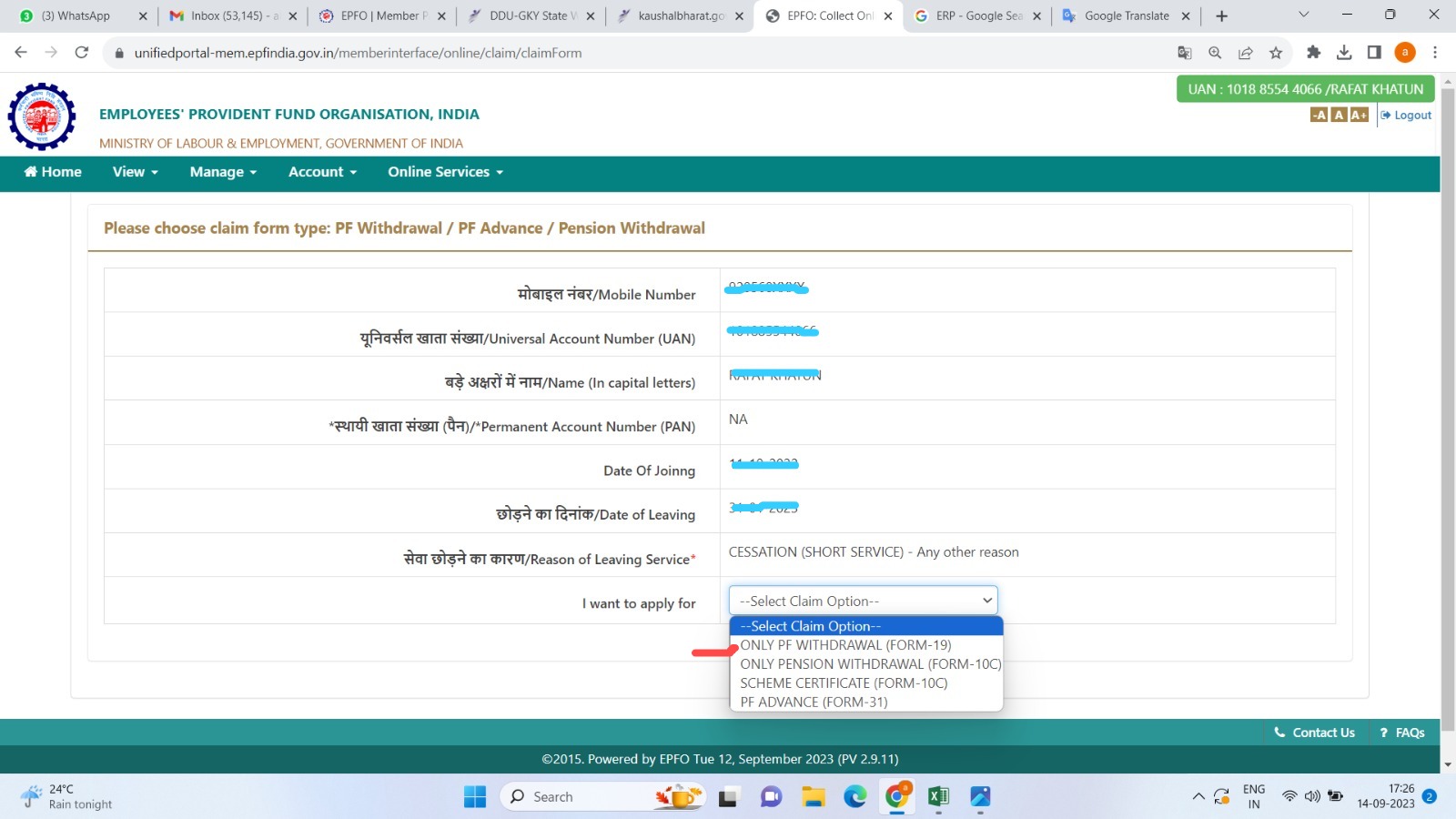

the claim form will open in which select the claim option, address, and passbook or checkbook have to be uploaded.

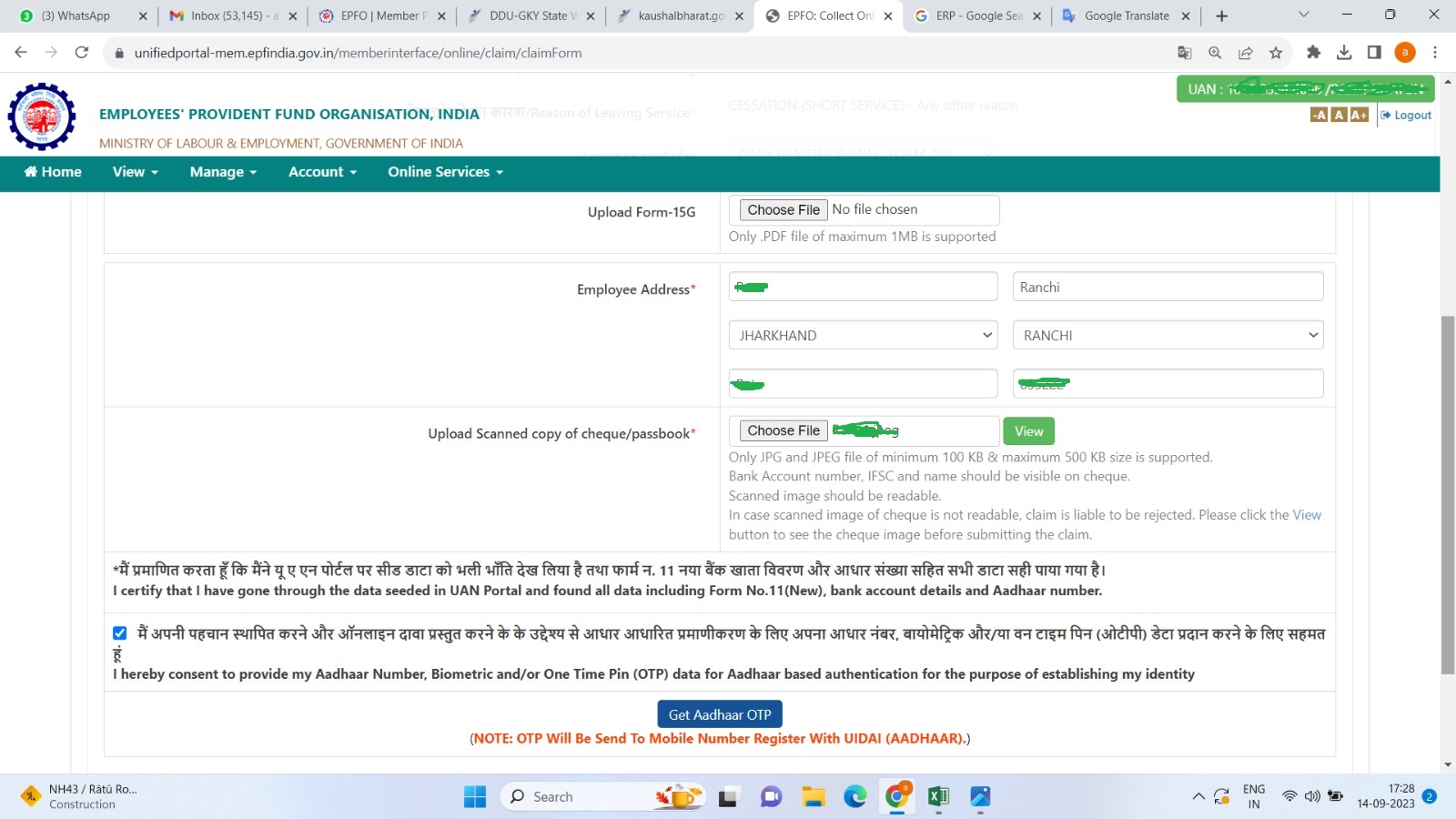

To withdraw the full PF amount you have to both Only PF Withdrawal(Form-19) and only pension withdrawal (form-10 C) one by one. first, Select only pf withdrawal (form-19), insert your Address, Form 15 G(if your PF withdrawal claim amount above 50,000) and upload cheque book or Passbook of account.

→Before Uploading the passbook, check the Name, Account No, IFSC, and bank-authorized person Sign and Stamp are clearly visible on the passbook or Not and Matched with PF bank KYC Details.

→Before Uploading Cheque book, Check the Account number, IFSC, and Name Digitally printed on the checkbook and Matched with PF bank KYC Details.

→ Before Uploading Cheque book or Passbook check the image size (greater than 100 KB and Less than 500 KB)

→Form 15 G is Available on Google ( if your PF withdrawal amount is less than 50,000 Rs Form 15 G is not Required).

→ Form 15 G form only Required during apply of PF withdrawal claim( form-19) and Not Required during Apply of only Pension withdrawal claim( 10 C).

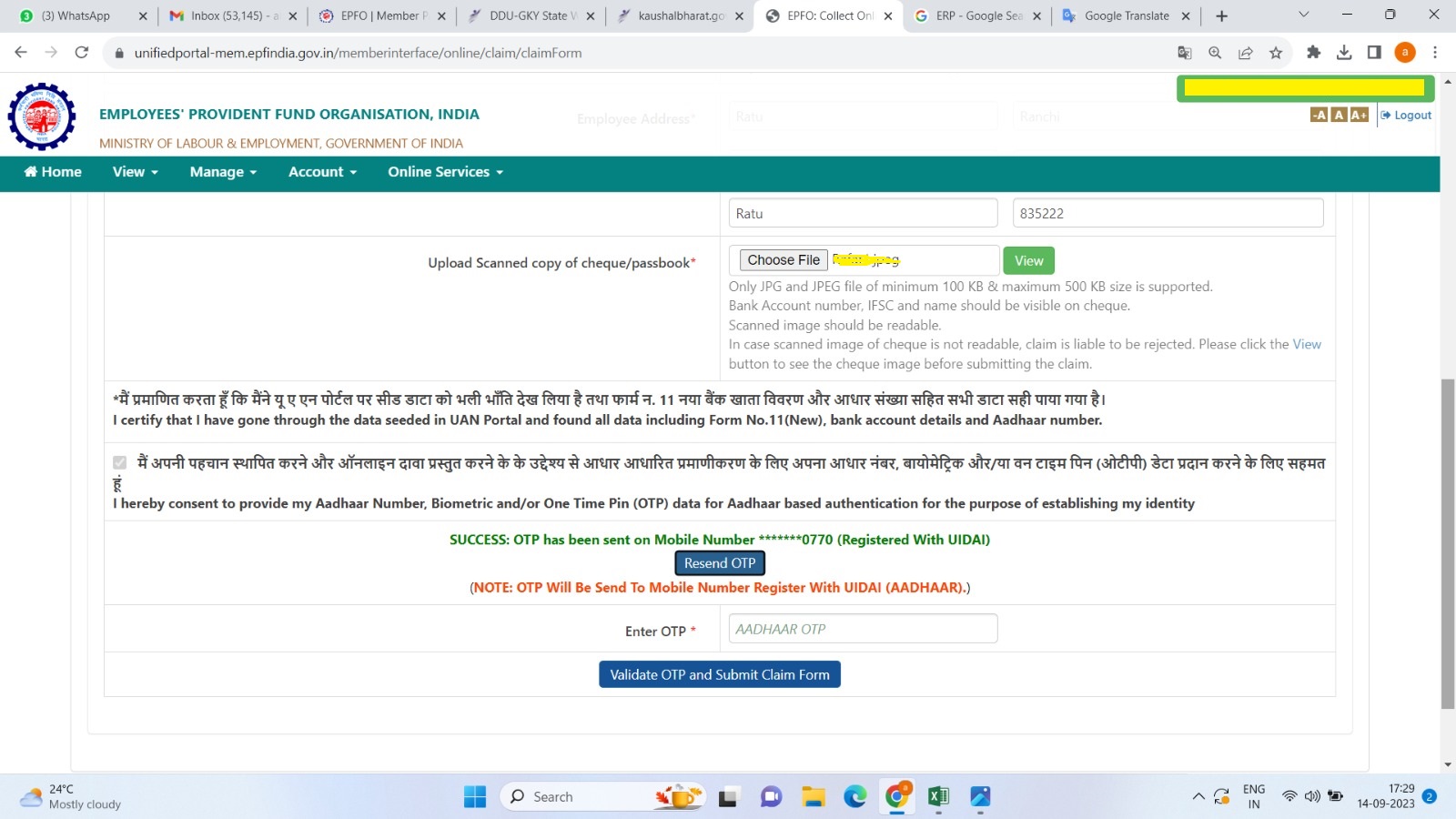

After filling out the claim form at the bottom Click on the Get Aadhaar OTP Button and 6-Digit OTP Received on your Mobile number.

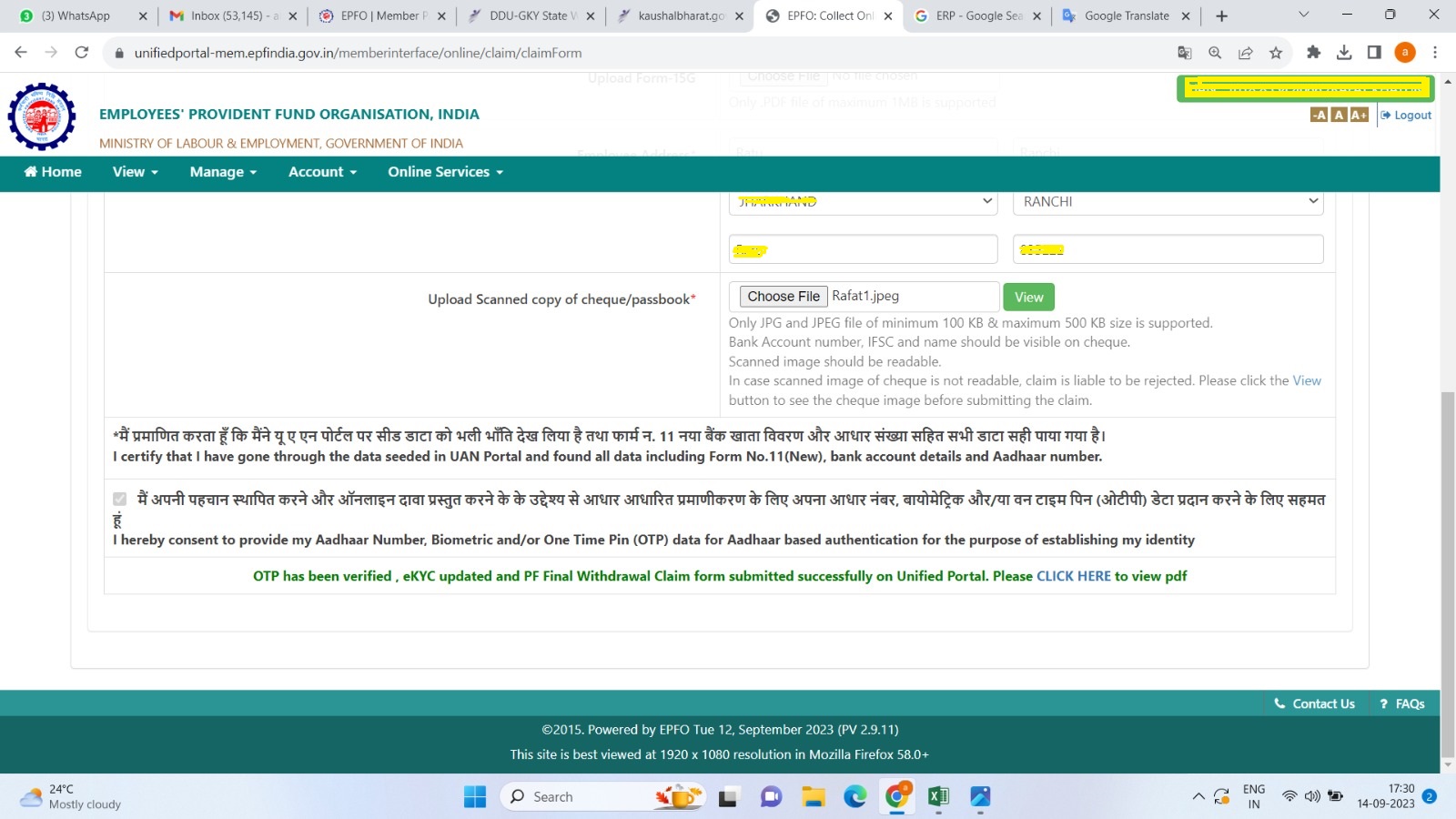

Go to the Enter OTP Text Box and type 6- 6-digit Aadhaar Authenticate OTP and Click on Validate OTP and Submit Claim Form Button.

After the Click on Validate OTP and Submit Claim Form Button, your claim is Submitted Successfully.

In the Next Step Same Process is repeated Again during the apply-only pension withdrawal claim and wait 10 to 15 days. After 10 to 15 both pf and pension amounts are credited to your Account.

All Comment (2)

Thank you so much Sir, queryflag appreciate your support.

Thank you Mr.Abhay for your contribution to our qureyflag community.